The Task Force emphasizes the tax reform that "have contributed to various tax amnesty schemes, the erosion of confidence in the fairness of the system. When has the Federal Bureau of Revenue (FBR), this observation, Invest-ment of its tax system studied: in 2008, would was not issued for the benefit of the "cheats" is. Like any other tax amnesty scheme, the scheme is an admission of inability to control the machine to collect the tax from potential taxpayers and a slap in the face of honest taxpayers. Have Millions of dollars for "re train 'FBR went down the drain output? It seems that we have more such systems in the future, Sec 120-A was introduced in the Finance Act 2008, which at FBR on these systems. According to the SA 2008, were the fraudster be able to invest tax revealed two per cent of the market value of all investments movable / immovable property, to pay undisclosed / unexplained / assets at any time after 1 July 2008 to December 31, 2008th will be asked no questions about the origin of these assets, investments, etc. The registrant provide such financial assets, is paid after tax.

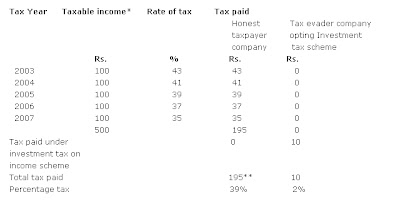

The scheme applies to all these assets to 30 June 2007. The market value on the basis of this tax must be paid is not defined yet. The reason not to prescribe the basis for the valuation of assets / investments were specified as follows: "The regime of" investment tax credit - 2008 "is a voluntary program that the government has rested in the trust, taxpayers and the opportunity was given to justify the unexplained assets and not put to a nominal interest rate of two percent of the market value of assets as we have said frankly. "However, the confidence not by taxpayers, but in the evaders.The tax on market value as of the 30th is June 2008 will be given. Once subscribed, and will be placed on the balance, the taxpayer is entitled to depreciation with effect from the 01 July 2008, when a second 23 of the Regulation. Suppose there are two companies with limited liability. It is an honest taxpayer who pays the tax over the last five years and the other a tax fraudsters now attracted by the tax system for investment to declare his assets not disclosed. Let us assume that every company deserves RS100 in each of those years. The tax liability in each of these cases will be as under:

* Effect of the reinvestment of income is not taken over, which would otherwise increase the tax liability of honest taxpayers.

* The tax compliance costs, opportunity costs, additional fees for late payments, etc. would have to be paid by honest taxpayers and tax evasion, not such a price.

The regime seems to have been written in haste. It is simple and the same result will now be made by issuing circulars. First was the deadline by which the assets were recorded by the system mentioned that June 30, 2008, later explained in Circular No. 7 that it intends to be 30 June 2007. Realized his error in the scheme and in Circular No. 7, was issued another Circular No. 8 of 2008, amending the original scheme. Now it is found that the scheme to include all assets and unreported income, the tax was, however, not until 30 Disbursed in June 2007. But what would happen in cases where a person filed tax on fixed assets by June 30, 2008, before the question of clarification or amendment? One source of dispute has already been created. The plan foresees the need for the taxpayers of the year 2008 for the new use of a tax return for tax year 2008 and the next three consecutive financial file. The department should not question the source for the acquisition of assets declared under the previous regime for years, and requiring notification, if applicable, for the last five years. Who can be more generous than FBR? The plan does not specify the consequences of filing a subsequent return taxes on income up to tax year 2011. No default clause in the system is in place. However, the FBR in a circular further said that in such cases, the immunity should be independent of the system. If the regime itself is silent on this point, would any suggestion of a clarification in conflict with the express authorization of Section 120-A of the order. Although later in a newsletter it was suggested that the valuation of assets on the legal and accounting practices can not, the ILC could be done in denying his assessment. This means that the registrant may not avoid taxes by declaring assets under-specified value.

If the plan says that its scope extends to current and new taxpayers, in Circular No. 7, below, explains: "The scheme applies to all undisclosed assets / income, which could not be disclosed to stay in one way or another and UN says. levied outstanding appeals and / or identified by the department would be under the normal law and not be processed in accordance with specific provisions of the plan. "interpretation above implicitly means that the concession only if the department could not get hold black money because all (because of the failure of the Commission, inefficiency, collision, according to some) and not where there is a genuine disagreement over the valuation of an asset or the amount of income. Similarly, if an asset was reported at a value lower than the true, strictly speaking, it is not reported or not disclosed, so the above information is based, it is not covered by the regime. However, the same circular 7 that for the period up to fiscal year 2007, which prohibits a taxpayer under the law, including legal reporting or non-declaration of income and wealth. The FBR is the subject of a comprehensive code to cover all relevant issues will be eliminated for all ambiguities.

The FBR should now understand that the reforms do not mean sitting in a glass house in obtaining results through web-mail and wage increases. The real reform would be unjust if the current tax system is through a just, fair and equitable tax replaced in order to maintain socio-economic development of our people. The reforms can only succeed if the honest taxpayers and tax evaders are not encouraged by such measures. The legislature, instead of patronizing and ineffective benefit must promote the culture of tax under the FBR for the task, because it collect the amount due to tax evaders to. The Fiscal Responsibility Act should, they contain a clause stating that the amnesty regulations. FBR new president can declare that it 2008 is the final settlement of the tax amnesty, or at least none of these plans would be given once known within the next 20-25 years? Such a commitment would demonstrate how effective these reforms and how FBR may, after all the changes. Tax law should be clarified a little more relaxed, if a taxpayer a taxpayer on a regular and rigorous, if a person does not pay any taxes against the tax. Only this change should consider a culture of tax evaders else, or ITS, which will support only a "tax trap". When fraudsters use tax amnesty for 61 years without payment of any taxes, why should they pay taxes to two percent reduction in taxes. What then is the solution? Do not overwrite existing taxpayers, the new search. If the cost of compliance would be lower than the potential costs of non-compliance, the tax would grow culture.

No comments:

Post a Comment